The accounts receivable ratio serves two important business functions.įor starters, it allows businesses to understand how quickly payments are collected, allowing them to pay their bills and strategically plan future investments. Accounts Receivable Turnover formula Importance

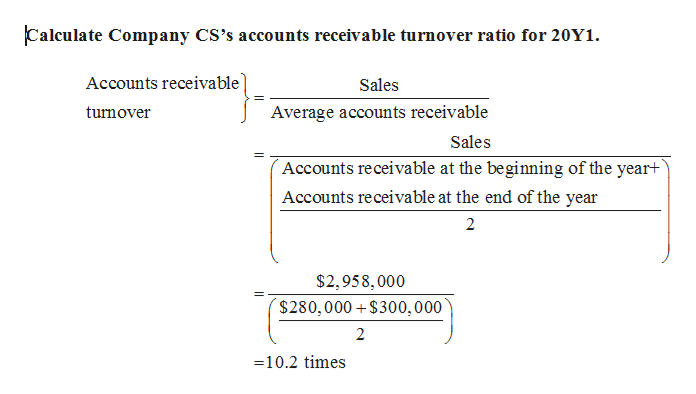

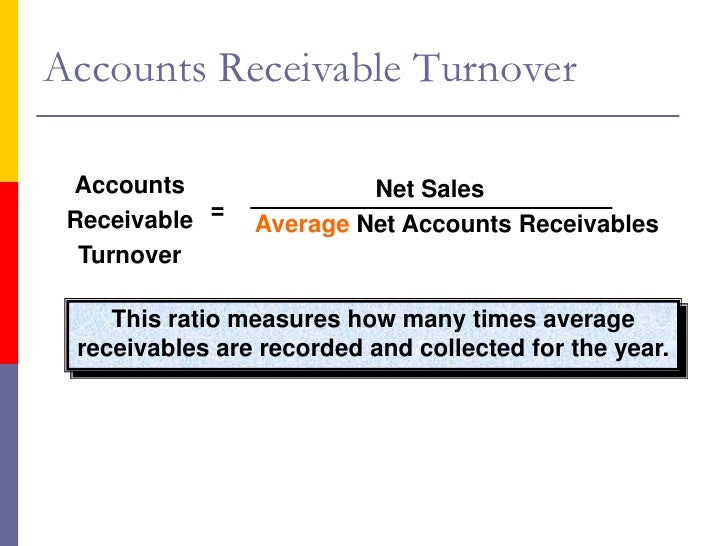

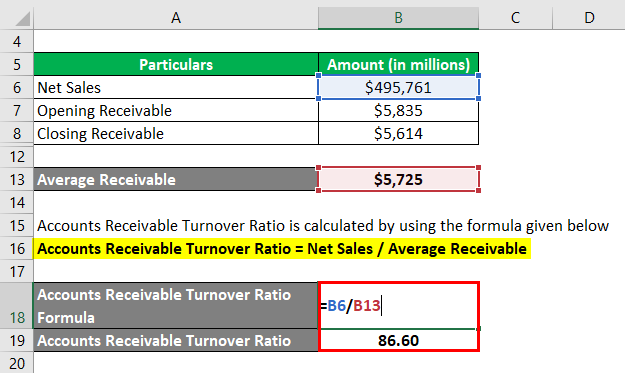

This puts businesses at risk of not receiving their hard-earned cash for the products or services they provide on time, which could lead to bigger financial problems.Įnsuring that your company collects money owed to it is advantageous for internal and external financial engagements.Īlthough accounts receivable turnover ratios vary by industry, higher ratios usually make a better impression on potential investors or financial institutions that provide loans.Īs a result, exercising due diligence in accounts receivable revenues directly impacts an organization's bottom line. In that case, it could indicate that they are failing to bill customers regularly and accurately or remind them of money owed. Suppose a company's receivables turnover goes unchecked and unmanaged for an extended period. This efficiency ratio considers an organization's receivable balances and receivable accounts to determine its cash flow situation. To work toward and achieve financial security, businesses must understand their accounts receivable turnover ratio. Explaining the Accounts Receivable Turnover formula It is used to assess how well companies manage the credit they extend to their customers by determining how long it takes to collect the outstanding debt throughout the accounting period. The accounts receivable turnover ratio, also known as receivables turnover, is a metric used in business accounting. Accounts Receivable Turnover Ratio - Formula, Examples

0 kommentar(er)

0 kommentar(er)